accumulated earnings tax reasonable business needs

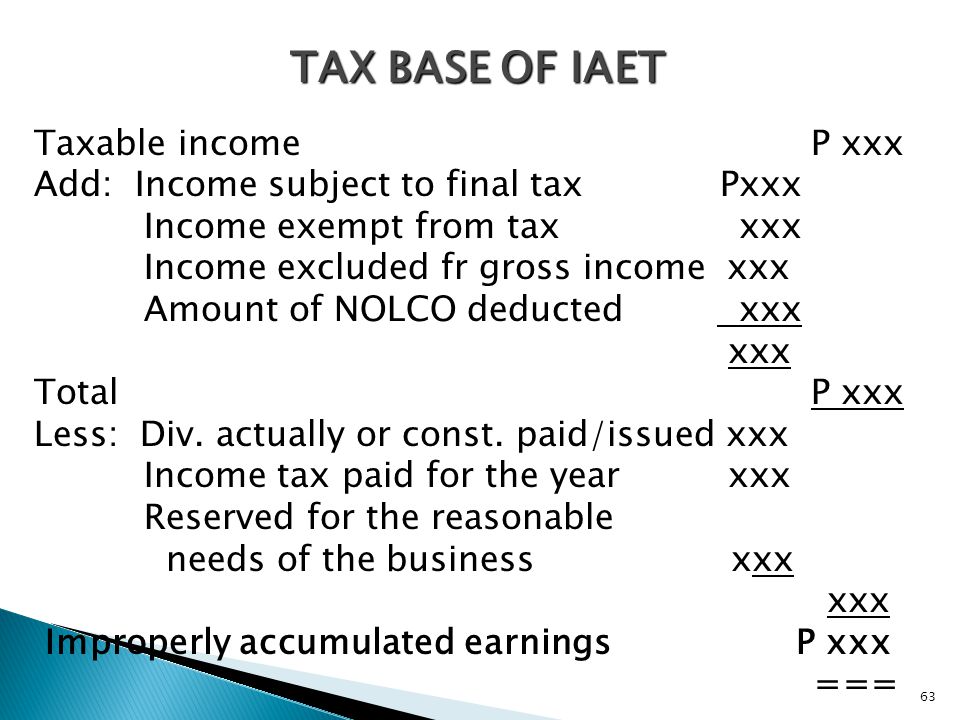

In simple and plain language improperly accumulated earnings tax is a penalty tax upon a corporate taxpayer for accumulating so much net income after tax beyond the reasonable needs of the business. The AET is a 20 annual tax imposed on the accumulated taxable income of corporations.

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

Retained earnings are an integral part of equity.

. The accumulated earnings tax is a penalty tax imposed on a corporation that is formed or used to help the shareholders avoid paying income tax by. Retained earnings are a total of all the accumulated profits that a company has received and has not distributed or spent otherwise. If the accumulated earnings tax applies interest applies.

Section 43 of the Corporation Code of the Philippines in effect prohibits a stock corporation to maintain a retained earnings more than 100 of. Her equity balance includes her original 50000 contribution and five years of accumulated earnings that were left in the business. Draw to pay yourself.

531-537 and the personal holding company PHC tax under Secs. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. We all know its in our best interest to do it every year but damned if we do.

NasdaqBCRX today reported financial results for the second quarter ended June 30 2022 and provided a. A Corporation or an LLC that elects C Corporation tax status can retain up to 250000 without having to justify and pay a higher tax rate on its accumulated earnings. However if the company presented a statement of retained earnings for 20X5 the opening balance would be adjusted by 280 400 30On a pretax basis 20X5 income would increase by 3600 and after-tax income would increase 2520 3600 30 x 400 for the impact of the change in years before 20X5.

An income tax return needs to be made to the tax office by the 31st March for the prior tax year. A business owner needs to be very clear about the tax liability incurred whether the distribution is. GAAP net revenues from digital channels were.

Q2 2022 ORLADEYO net revenue of 652 million FY 2022 ORLADEYO net revenue expected to be between 255 million and 265 million RESEARCH TRIANGLE PARK NC Aug. Accumulated earnings of the organization for the reporting year is the final financial result of its activities fewer dividends paid. However if the C corporation retains earnings above the amount the IRS considers to be the reasonable needs of the business the corporation may be assessed for the accumulated earnings tax.

Computing earnings and profits EP for a C corporation client is the dental cleaning of the tax world. Aside from the scheduled tax allowance provided in the table below there are limited allowances for the following. Please refer to the tables at the back of this earnings release for a reconciliation of the companys GAAP and non-GAAP results.

We would like to show you a description here but the site wont allow us. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to an accumulated earnings tax of 20. These are the accumulated earnings tax AET under Secs.

It applies to all corporations unless an exception applies that are formed or availed of for the purpose of avoiding the income. For the quarter ended June 30 2022 Activision Blizzards net revenues presented in accordance with GAAP were 164 billion as compared with 230 billion for the second quarter of 2021. Consideration should be given to the relationship between IRC 531 Imposition of accumulated earnings tax IRC 541.

Until the applicable Expiration Date as defined below we are offering to the holders of all of our outstanding Class A warrants the Class A warrants Class B warrants the Class B warrants and Class C warrants the Class C warrants and together with the Class A warrants and Class B warrants the warrants each to purchase shares of common stock par. Income Tax on Earnings. Actual Expense or Business Activities.

04 2022 GLOBE NEWSWIRE -- BioCryst Pharmaceuticals Inc. The accumulated after tax profits can be used to pay off corporate debt or for working capital to operate or grow the business instead of opening a Line of Credit loan. The issue will be dropped if it is concluded that earnings and profits have not been accumulated beyond reasonable business needs.

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

:max_bytes(150000):strip_icc()/GettyImages-1089395350-f33f180d2b234b268f6df527045f8de0.jpg)

Accumulated Earnings Tax Definition

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

/GettyImages-185121887-3537e49a2e394fe5927d3cfb1dd0a8fb.jpg)

Accumulated Earnings And Profits Definition

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

:max_bytes(150000):strip_icc()/a_10-5bfc387746e0fb0051486be9.jpg)

Accumulated Earnings Tax Definition

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc