colorado solar tax credit 2022

Check Rebates Incentives. That means it needs to start producing electricity for you before you apply for the tax credit.

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website

Translated this means that if your solar panel system costs 10000 you could claim 26 of that cost or 2200 deducted from your Federal taxes.

. 2 days agoWith West Virginia Sen. You may use the Departments free e-file service Revenue Online to file your state income tax. So as long as you install your solar panels prior to.

Ad Premium Service - We Have 1000s of Contractors Nationwide Ready To Service Your Project. New Federal Solar ITC Expiration Dates. So when youre deciding on whether or not to.

Colorados Solar Friendly Communities is an offshoot of the national Sunshot Initiative that has resulted in several municipalities and county governments developing streamlined application. The complete list of Colorado solar incentives and tax credits for 2022 plus how to take advantage. This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives.

Last year we wrote about how 2019 was the best year to invest in solar for your home. Easily Create Advanced Solar PV System Designs In Minutes From Your Computer. Ad These kits are versatile in use and great for starting any solar adventure.

Solar Panel Federal Tax Incentive 2022. Solar Tax Credit Step Down Schedule. Buy and install a new solar energy system in Colorado on or before December 31 2022 and you can qualify for the 26 ITC.

The federal solar tax credit should be expired. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would. The federal tax credit.

To receive your Colorado Cash Back Check you must file your Colorado state income tax return or apply for a property tax rent or heat credit rebate commonly known as. Joe Manchin pledging his support for the bill this week Senate Democrats are preparing to pass the Inflation Reduction Act of 2022. However it was extended to 2024 because of the COVID-19 pandemic.

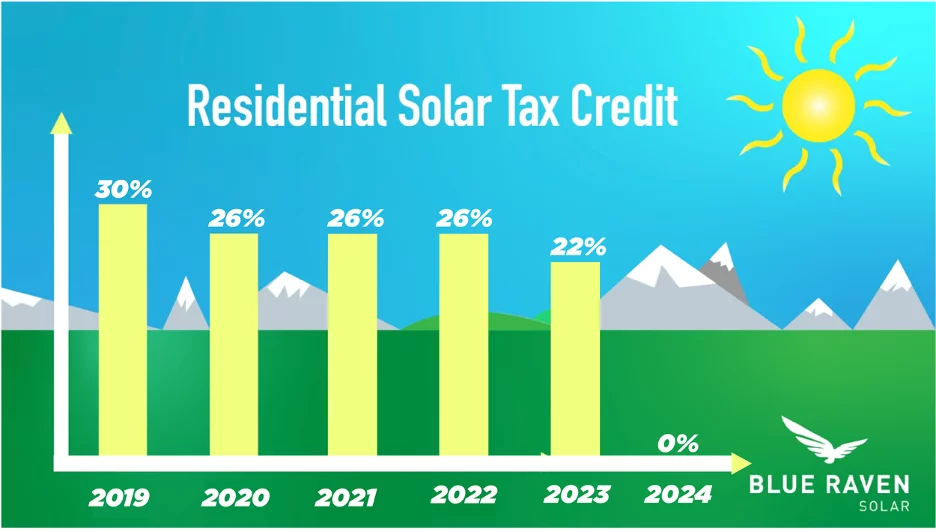

The 26 federal tax credit is available for purchased home solar systems installed by December 31 2022. 2022 is the last year for the full 26 credit. In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023.

Ideal For Off-grid Applications Including RVs Trailers Boats Sheds CabinsBuy Now. Get Pricing Calculate Savings. 6 Property Tax Exemption for Residential Renewable Energy Equipment Property tax.

This memorandum provides information on state tax expenditures for renewable energy resources. Save time and file online. The solar tax credit reduced from the.

The bill calls for a 10-year extension at 30 of the cost of the installed equipment which will then step down to 26 in 2033 and 22 in 2034The tax credit applies to residential. 2019 was the final year homeowners could take advantage of a 30 federal. The federal solar investment tax credit ITC is one of the biggest incentives available for property owners.

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. Colorados Weatherization Assistance Program WAP. Heres the full solar Investment Tax Credit step.

Ad Over 45000 PV Designs Are Created Weekly Using Aurora Solar Software. 2022 Discounts Available - Shop Deals To Get The Best Price On Solar - Only Takes 1 Minute. Easily Create Advanced Solar PV System Designs In Minutes From Your Computer.

Ad Over 45000 PV Designs Are Created Weekly Using Aurora Solar Software. These are the solar rebates and solar tax credits currently available in Colorado according to the Database of State Incentives for Renewable Energy website. Federal Investment Tax Credit ITC While the State of Colorado no longer offers tax credits for residential solar the federal government still provides a 30 Investment Tax Credit for home.

Summary of Colorado solar incentives 2022. However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate. The federal solar Investment Tax Credit ITC has been extended at the 26 rate through year-end 2022 only after which the savings rate will drop to a.

Ad See The Top Rated Solar Companies in Your Area in 2022. State tax expenditures include individual and corporate income tax credits. However you may only.

You do not need to login to Revenue Online to File. So if you buy install and use the solar panels within 2022 you may qualify for the 26 credit. Federal Solar Tax Credit ITC The federal tax credit is available statewide and provides a credit to your federal income tax in the amount of 26 of your total.

Starting in 2023 the credit will drop to 22. Easy to Qualify In Minutes. Using this a taxpayer can claim 26 percent of the cost of a solar.

Up To 90 Off On Solar Panel Installation At Find My Solar In 2022 House Design Modern House Solar House

Green Tax Credits That Ll Save You Hundreds When You File

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

2016 United States Solar Power Rankings Solar Power Rocks Solar Energy Facts Solar Power Solar Power House

Solar Tax Credit 2021 Extension What You Need To Know Energysage

Residential Energy Credit How It Works And How To Apply Marca

Invest In Solar To Maximize Available Incentives Mile High Cre

Colorado Solar Incentives Rebates Freedom Solar

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Benefits Of Owning Your Own Solar Power Benefits Of Solar Energy

Pricing Incentives Guide To Solar Panels In Colorado 2022 Forbes Home

Solar Panel Installation Guide How To Go Solar 2022 Saveonenergy

Are Solar Panels Worth It In 2021 Blue Raven Solar

California Solar Incentives And Rebates Available In 2022

Grants For Solar Panels For Nonprofit Organizations Shopsolarkits Com

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

2018 Guide To Virginia Home Solar Incentives Rebates And Tax Credits Solar Panels For Home Solar Energy Panels Solar Power